Koh Samui’s THB30.3 Billion Property Market Shifts Gear with Surge in Condos and Villa Rentals

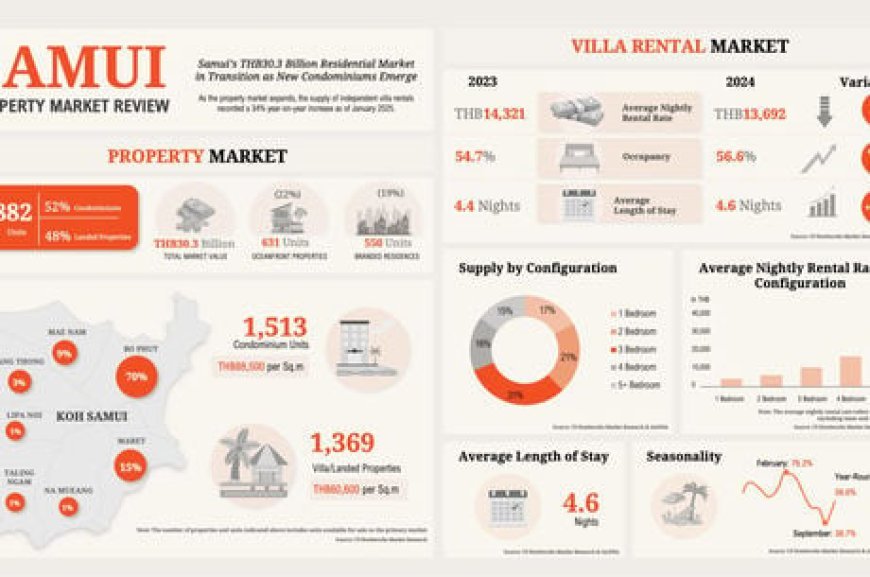

KOH SAMUI, THAILAND - Koh Samui’s residential property market is undergoing a significant transformation, marked by rapid expansion, a diversification of offerings, and intensifying competition in the rental sector. According to the newly released 2025 Samui Property Market Update by C9 Hotelworks, the island's property market—valued at THB30.3 billion—is transitioning from its traditional villa-centric model toward higher-density developments, especially condominiums, while adapting to evolving investment trends and rising international interest.

Booming Supply Reshapes Market Dynamics

A defining trend of Samui’s current market is the sharp increase in the supply of independent villa rentals, which grew by 34% year-on-year as of January 2025. This influx of inventory has sparked price competition, pushing down average nightly rental rates by 11% year-on-year in Q1 2025 to THB13,012. However, despite these softer rates, occupancy rose by 5.7 percentage points to 71.5%, indicating resilient demand driven by the island’s continued appeal among travelers seeking luxury and privacy.

What sets Samui apart is its fundamentally strong hotel and property market. Compared to other Thai resort destinations where land prices have skyrocketed, Samui’s relatively low land cost provides a compelling platform for competitively priced luxury villas—many of which offer spectacular ocean views. Bill Barnett, Managing Director of C9 Hotelworks

At the same time, Samui’s residential development pipeline is seeing a clear pivot toward larger-scale, high-density resort-style condominiums. Notable among these are two upcoming projects: Anava Samui (564 units) and Wing Samui (533 units), signaling a broader diversification of the island’s residential offerings beyond traditional villas. These developments cater to a growing base of lifestyle buyers and investors looking for more affordable and manageable property options.

Residential Supply and Submarket Trends

The primary market now consists of 2,882 units across 117 projects. A commanding 70% of this inventory is located in Bophut—a central submarket encompassing Samui Airport and the popular Chaweng Beach. Bophut is followed by Maret (15%), Mae Nam (9%), and Ang Thong (3%).

Condominiums now represent 52% of the total market supply, underscoring their growing dominance in the new development landscape. Villas or landed properties account for the remaining 48%, still holding a strong position but gradually yielding ground to vertical developments.

From a price standpoint, condominiums have a median sales price of THB88,500 per square meter, while landed properties average THB60,600 per square meter. For a one-bedroom condominium (40–70 sqm), the median price is approximately THB3.5 million. Two-bedroom units (80–110 sqm) fetch THB7.2 million. Villas, on the other hand, command significantly higher prices, with three-bedroom units (250–350 sqm) averaging THB14.9 million.

Competitive Villa Rental Market

As of 2025, Samui’s villa rental market comprises 3,055 properties, mainly managed by third-party operators. These villas typically serve dual purposes: personal holiday homes and income-generating investment properties. Two- and three-bedroom villas dominate the landscape, accounting for 21% and 31% of the market respectively. Larger villas with four or more bedrooms make up 31% of the supply, catering to extended families and group travelers.

The villa rental market is highly seasonal, with occupancy dipping to 38.7% in September and peaking at 76.2% in February. The average length of stay hovers between four and five nights. Though rates have declined amid rising supply, the segment continues to appeal to higher-spending tourists who prefer privacy and exclusivity. Interestingly, while the average nightly rental rate fell to THB13,012 in Q1 2025, occupancy gains suggest a volume-driven strategy is bearing fruit for many operators. This trade-off points to a maturing market where profitability hinges on operational efficiency and strategic pricing.

Bophut: Boutique Villas Meet High Demand

One of Koh Samui’s most in-demand villa submarkets is Bophut, where interest in boutique-style residential developments continues to grow. Projects in this area offer a compelling mix of elevated design, privacy, and proximity to key attractions like Fisherman’s Village. New luxury villas in Bophut are tapping into the rising appeal of wellness-focused living and contemporary tropical aesthetics, underscoring the submarket’s position as a magnet for lifestyle-oriented buyers.

Market Value Distribution and Configuration

Geographically, 85% of Samui’s market value is concentrated in Bophut, Maret, and Mae Nam. This clustering highlights both the desirability and development maturity of these submarkets. Notably, oceanfront properties make up 631 units of the total supply, while branded residences account for 550 units, reflecting a growing interest in premium, lifestyle-oriented investments.

By configuration, property prices scale with size. Villas with two bedrooms (150–250 sqm) are priced around THB12.2 million, while larger four-bedroom units (400–500 sqm) can exceed THB28.9 million. For condominium buyers, affordability and lifestyle amenities continue to be key selling points, with developers targeting foreign buyers and urban Thai investors alike.

Outlook and Implications for Investors

Samui’s evolving real estate landscape presents a nuanced picture for investors and developers. The surge in supply—both in villas and condominiums—is creating downward pressure on pricing, especially in the short-term rental segment. However, this is being partially offset by rising demand, improved occupancy, and increased flight connectivity.

Moreover, the emergence of large-scale condo projects marks a pivotal shift in Samui’s residential positioning, making the island more accessible to a broader range of investors and second-home buyers. This structural change, coupled with the island’s premium tourist positioning, suggests that Samui’s real estate market is on the cusp of entering a new phase of volume-driven, diversified growth.

Developers and investors must now navigate a more competitive, dynamic market where differentiation, location, and value-added services will be critical. With the right strategic approach, Samui continues to offer attractive opportunities in both capital appreciation and rental yield.

As the island’s infrastructure and international connectivity continue to improve, its real estate sector is poised to remain a focal point for both lifestyle buyers and institutional investors looking to tap into Southeast Asia’s resort-driven residential markets.

Download and read C9 Hotelworks Samui Property Market Review 2025 here.

About C9 Hotelworks

C9 Hotelworks is led by founder and Managing Director Bill Barnett, who brings over 30 years' experience in the Asian hospitality and real estate sectors. Prior to founding C9 in 2003, Bill held senior executive roles in hotel operations, development and asset management. He is considered to be a leading global authority on hotel residences, and has sat at almost every seat around the hospitality and real estate table. Bill promotes industry insight through regular conference presentations at key events and contributes to numerous industry publications. For more information contact www.c9hotelworks.com.

Bill Barnett

Managing Director, C9 Hotelworks

+66 (0)8 1956 1802

C9 Hotelworks Ltd.