In Focus: Indonesia

Indonesia

Indonesia, officially known as the Republic of Indonesia, is the world’s largest archipelagic nation, spanning over 1.9 million square kilometres across more than 17,000 islands. Strategically located between the Indian and Pacific Oceans, it stretches over 5,000 kilometres and shares land borders with Papua New Guinea, East Timor, and Malaysia. With a 2024 estimated population of 284.4 million, Indonesia is the fourth most populous country globally.

Its economy is supported by major industries such as petroleum and natural gas, manufacturing, mining, agriculture, and increasingly, tourism. Tourism is a vital pillar of Indonesia’s economy, contributing approximately 5.6% of its Gross Domestic Product (GDP) in 2019 and 5.1% in 2024, nearing a full recovery in GDP contribution. The country is world-renowned for its rich cultural heritage, tropical beaches, biodiversity, and UNESCO World Heritage Sites such as Borobudur Temple, Komodo National Park, and the cultural landscape of Bali.

According to the World Travel & Tourism Council (WTTC), in 2025, Indonesia’s tourism sector is projected to reach IDR 1,269.8 trillion (21% higher compared to 2019), or 5.5% of GDP, driven by a record high international visitor spending of IDR 344 trillion, up 12% from the 2019 record of IDR 302 trillion. WTTC states that this success reflects strong public-private collaboration and leadership focused on sustainability, resilience, and community inclusion. Looking ahead, tourism is expected to contribute IDR 1,897 trillion by 2035 and supporting nearly 17 million jobs, generating 3 million new jobs compared to 2025, marking a transformative decade for the country’s travel and tourism landscape.

With popular destinations like Bali, Yogyakarta, Labuan Bajo, and Lake Toba, Indonesia appeals to a broad spectrum of tourists, from luxury and eco-tourism to adventure and spiritual travel. In recent years, there has been rebound in international arrivals, supported by strategic infrastructure investment and government initiatives such as the “10 New Balis” program to diversify tourism beyond Bali. As of 2024, the sector continues to show promising signs of recovery and growth, positioning Indonesia as a key tourism player in Southeast Asia.

Economic Outlook

Economic Performance & Outlook

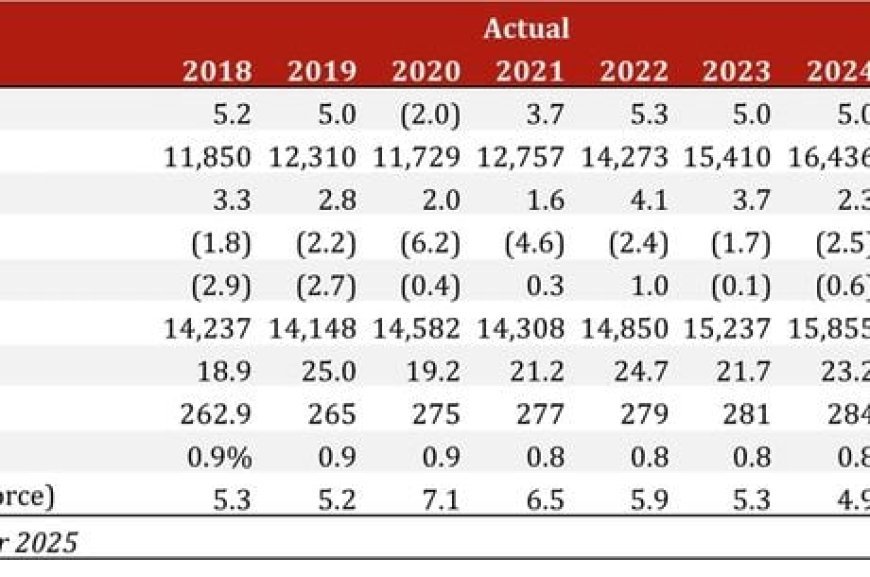

Indonesia has demonstrated consistent macroeconomic resilience, underpinned by a four-year pre-pandemic average GDP growth of 5.0% and a 2.5% compound annual growth rate (CAGR) in GDP per capita (PPP). Following a contraction in 2020, economic activity rebounded strongly, with growth stabilising at 5.0% in 2023–2024. Medium-term forecasts remain favourable, driven by structural reforms, and infrastructure investments. With GDP per capita projected to reach USD22,418 by 2029, Indonesia remains well-positioned as a key emerging economy in Southeast Asia.

Currency Exchange Outlook

The Indonesian rupiah is forecast to depreciate modestly, averaging Rp16,434:US$1 in 2025. This trend reflects persistent global uncertainties, including US monetary policy ambiguity and geopolitical tensions, which weigh on emerging market currencies. The rupiah’s weakness is expected to extend through mid-2026. While structural fundamentals remain intact, any substantial appreciation is unlikely in the short term.

Foreign Direct Investment

Indonesia’s foreign direct investment inflows are projected to reach USD23 billion in 2024, marking a moderate increase from 2023. Annual inflows are expected to stabilise between USD23-24 billion in the short-term, still below the USD25 billion recorded in 2019. Despite global uncertainties, Indonesia’s improving macro fundamentals and tourism-driven infrastructure developments will continue to attract investment.

Interest Rates

Bank Indonesia (BI) reduced its policy rate to 5.75% in January 2025. BI maintained this level in February, balancing the need to support growth to preserve rupiah stability amid recent currency depreciation. With inflation within the 1.5–3.5% target range, BI is expected to implement one more 25-basis-point cut in 2025. Gradual easing is projected through 2029, with the policy rate stabilising in the 3.5–4.5% range.

Inflation

EIU forecasts Indonesia’s inflation to average 2.3% in 2025, driven by continued rupiah depreciation and rising costs of imported goods such as rice and fuel. The government’s decision to delay a value-added tax (VAT) hike on non-luxury items is expected to help mitigate some inflationary pressure. Over the medium term, headline inflation is projected to average around 3% from 2025 to 2029, remaining within Bank Indonesia’s target range.

Political Landscape

2025 marks President Prabowo Subianto’s first year in office. His unusually large administration indicates expanded budgets and bureaucracy. Key policy priorities include infrastructure development, EV battery, and free school meals programmes. However, planned budget cuts, particularly to projects like the new capital, Nusantara, have sparked protests, posing a short-term stability risk. Nonetheless, with support from major Islamic parties and Vice President Gibran Rakabuming Raka, Prabowo is expected to complete his term through 2029.