Greek Hospitality Industry Performance 2025 Q2

H1 2025 demand review

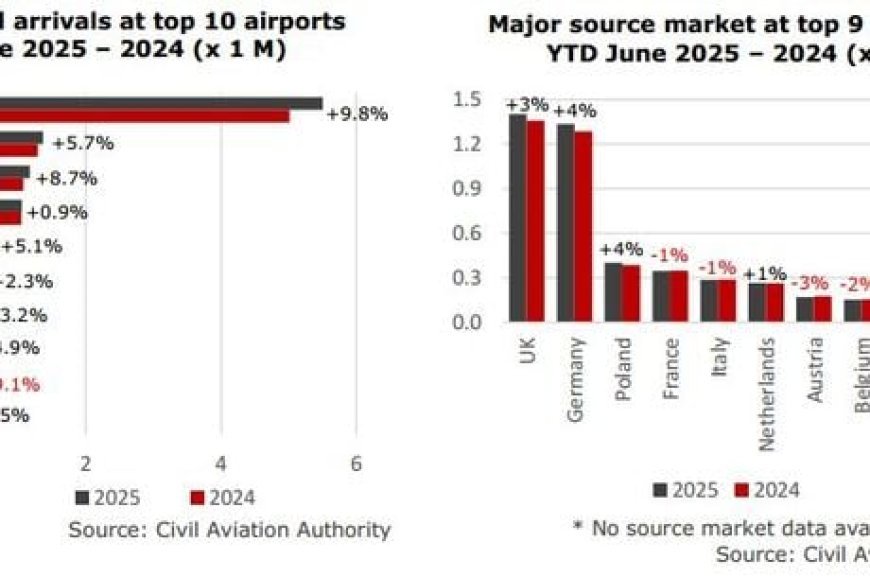

International arrivals at Greek airports increased 6.3% in YTD June 2025/24, reaching 12 million. The top 10 airports accounted for 95% of all international arrivals, with Athens alone representing 46%. However, 31% of the below presented international arrivals for Athens were Greek residents based on data of Athens International Airport.

For the top 9 airports (excluding Athens) the United Kingdom remained the largest source market, followed by Germany and Poland, which recorded the largest increase during the first 6 months. Arrivals from France, Italy, Austria and Belgium declined.

In Santorini arrivals declined 19.1% H1 2025/24 due to a series of minor to moderate earthquakes, the strongest of which measured approximately 5.0 on the Richter scale in February 2025. As of May 2025, seismic activity in Santorini has subsided significantly, returning to normal levels. Arrivals from the UK declined (-22.9%), France (-37.6%) and Germany (-11.6%), while arrivals from Italy, the second largest source market for the Santorini airport, remained stable.

Among the major source markets at the Mykonos airport a mixed picture is noted with a drop of 19.0% in arrivals from France, while those from Germany increased by 18.1% during the same period.

The Bank of Greece reported a 12.7% increase in travel receipts for YTD May 2025/24, attributed to strong performance in April (+17.6%) and May (+17.9%). During the same period, arrivals increased by 2.1%, although May saw a 2.7% decline compared to the same month in 2024.

The performance of the Greek tourism sector in 2025 has been shaped by a combination of natural, geopolitical, and economic pressures. In addition to the Santorini earthquakes, severe heatwaves and wildfires in June and July led to site closures across key destinations. Geopolitical tensions—including the ongoing Ukraine war, the Israel–Iran conflict, and Turkey’s military campaign in Syria further fuelled global uncertainty. At the same time, economic challenges in major source markets have reduced disposable incomes, while international trade policies associated with President Trump continue to contribute to global uncertainty.

Still, travel remains a priority for many, and international arrivals to Greece continue to grow despite these headwinds.

H1 2025 hotel performance review

Athens: signs of stabilization amid rising supply

Hotel performance in Athens began 2025 with solid results, showing increases in both occupancy and ADR in Q1 compared to the same period in 2024. In April, occupancy declined by 5.6%, while ADR rose by 4.6%, resulting in a 1.3% drop in RevPAR. May was strong, but in June, both occupancy and ADR declined by 2.0% and 3.9%, respectively.

After several years of robust post-COVID expansion, a stabilization of hotel performance is expected. Hotel supply has increased significantly, and a substantial pipeline of new rooms is under development. At the same time, the Short-Term Rental (STR) market in Attica continues to grow, with a 17% increase of units in 2025, putting additional pressure on hotel occupancy, while prices in the STR sector continue to rise.

Preliminary July figures indicate a drop in both occupancy and ADR for the Athens hotels. Demand was weak putting pressure on prices and for August the market is not optimistic.

Thessaloniki: growth in H1

Hotel performance in Thessaloniki showed steady improvement during the first half of 2025, with occupancy increasing by 4.3% and ADR rising by 4.4% compared to H1 2024.

Resorts: lower occupancy, stronger revenue metrics

The resort hotel sector in Greece opened the season in April 2025 with a 4.1% decline in occupancy compared to a year earlier. However, Total Revenue per Occupied Room (POR) rose significantly by 25%, while rooms available increased by 27% in April 2025 compared to same month last year.

Overall, during Q2 2025, weak occupancy performance was recorded. YTD June 2025/24, occupancy declined by 1.1%, while Total Revenue per Occupied Room increased by 10.3%, with May as the weakest month. As a result, Total Revenue per Available Room (RevPAR) improved by 9.1% in H1 2025/24.

Greece lacks a tourism vision

After years of record-breaking growth in Greek tourism, an increasing number of stakeholders are voicing concern over the absence of a clear strategy for Greek tourism and the urgent need to address key challenges — many of which were outlined in our 2024 Q3 newsletter.

We note that Greece still does not have a defined vision for its tourism sector - one that expresses a long-term aspiration and a desired future state, supported by a new strategy capable of bringing this vision to life. The need for both has by now become acute. Tourism sector development is needed that no longer erodes what makes Greece attractive — but rather actively protects and enriches it. Tourism should serve local communities, their societies and environment, not displace them; and it should support cultural heritage and continuity, not dilute it or even delete it.

Greece has all the right assets: a rich mosaic of landscapes, living traditions, local food cultures, distinct regions, a vibrant and warm population and a globally powerful brand. The path of development adopted to date requires drastic, coordinated, and enforced adjustments, starting with:

- Setting national goals and priorities in measurable form

- Measuring the holistic impact of existing tourism activity and development effectively

- Completing and enacting national and local spatial plans

- Promoting projects on the basis of their positive sustainable footprint

- Promoting redevelopment, repositioning

- Allocating development rights effectively

- Ending uncontrolled short-term rentals

- Enforcing environmental, social and cultural protection consistently

- Prioritising critical infrastructure upgrades

- Using tourism tax mechanisms to meaningfully support disaster relief and climate adaptation efforts

The longer it takes, the harder it will be to reverse the course — and the more likely Greece’s brand promise will become hollow, if action is not taken.

Governance structures must follow strategy. While Destination Management Organizations (DMMOs) are increasingly being established in various regions and destinations, they too require a clear national vision, strong regulatory backing, and adequate resources to function meaningfully.

Investors and financiers will play a key role in shaping the future of tourism in Greece. By aligning their projects with a long-term national vision, they can both safeguard their investments and create value for all stakeholders.

Main hotel transactions

At the end of July 2025, it was announced that Spanish investment firm Azora acquired a 50.1% stake in Donkey Hotels, the hospitality group owned by the Ioannou family, who retain 49.9% of the business, represented by Mr. Christos Ioannou. Donkey Hotels consists of:

- Athenaeum Intercontinental (Athens), 5-star, 563 rooms

- New Hotel (Athens), 5-star, 79 rooms

- Periscope (Athens), 4-star, 22 rooms

- Semiramis (Kifissia), 4-star, 51-rooms

- Noūs Santorini (Santorni), 5-star, 119-rooms

Except for the Intercontinental, all properties are part of Marriott’s Design Hotels collection.

Azora’s first acquisition in Greece was completed in 2022, when it purchased the 5-star, 401-room Sheraton Rhodes from Lampsa SA for € 43.8 million. The group currently manages over 14,500 rooms across more than 60 hotels in Europe and the US.

Zeus International Hotel & Resorts acquired the Eretria Hotel & Spa in Evia. The deal was announced in July 2025 and was part of a strategic agreement with an international fund. The 4-star resort offers 220 rooms, 3 restaurants and 2 bars, spa & fitness center, large conference and meeting facilities, kids club, sports facilities and shops.

As of June 2025, ownership of the 5 hotels of Kipriotis & Sons in Kos, have been transferred to an entity controlled by HIG Capital Advisors LLC.

This follows the earlier January 2022 transaction, in which H.I.G. Capital, through its real estate/private equity vehicle, acquired approximately € 135 – € 140 million in non-performing loans from Eurobank, Piraeus Bank, and Attica Bank. These loans were previously held by G. Kipriotis & Sons and were secured against the following five hotel assets:

- Kipriotis Village Resort, 5-star, 709 rooms

- Kipriotis Panorama Hotel & Suites, 5-star, 253 rooms

- Kipriotis Maris Suites, 5-star, 183 rooms

- Kipriotis Aqualand Hotel, 4-star, 203 rooms

- Kipriotis Hippocrates Hotel, 4-star, 173 rooms

The complex also includes the Kipriotis International Convention Center, featuring the Hippocrates Hall, its largest hall, with 1,400 sqm of space and a 2,300-seat theatre-style capacity.

All hotels have been leased to Hotel Brain under a 10-year agreement, though the lease term may be subject to adjustment, according to Money Tourism.

According to the same source, in early July 2025, Brook Lane Capital acquired the 5-star, 418-room Porto Bello Royal and the adjacent 4-star, 326-room Porto Bello Beach Resort in Kos.

Aziz Francis, founder of Brook Lane, has been registered - effective June 20th, 2025 - as Vice President and CEO of the company operating under the commercial name Porto Bello Hotel.

GBR Consulting is the leading hospitality and tourism consultancy in Greece. Its experience includes market and financial feasibility studies as well as valuations and development plans for Hotels, Resorts, Spas, Marinas, Casinos & Gaming, Conference Centers & Arenas, Theme Parks, Golf Courses etc. GBR Consulting is affiliated to CBRE Atria, the Greek arm of CB Richard Ellis, providing together a specialized service for Tourism Properties Transactions. GBR Consulting possesses a database with financial data for over 1,000 hotel establishments in Greece and has a datashare agreement with STR Global, the word's largest databank of hotel operational data.